We take pride in offering a wide range of tax preparation services that cater to individuals, businesses, and organizations of all sizes. With our expert team of certified tax professionals, we are committed to ensuring that your tax obligations are not just met but optimized for your financial benefit.

Personal Tax Preparation: Our tax experts specialize in individual tax returns, ensuring you maximize deductions and credits while complying with the latest tax laws.

Personal Tax Preparation: For businesses, we offer tailored tax solutions, including corporate tax returns, partnership tax returns, and S-Corp returns.

Tax Planning and Strategy: We work with you to develop proactive tax strategies that minimize your tax liabilities and optimize your financial outcomes.

IRS Audit Support: Facing an IRS audit can be intimidating. We provide expert guidance and support to navigate the audit process smoothly.

Estate and Inheritance Tax Planning: We assist in estate and inheritance tax planning to ensure your assets are transferred efficiently to your heirs.

International Tax Compliance: If your tax situation involves international considerations, we have the expertise to handle complex international tax compliance issues.

State and Local Tax Services: We help you navigate state and local tax regulations, ensuring compliance and minimizing tax liabilities.

Quarterly Tax Projections: For businesses, we provide quarterly tax projections, helping you budget and plan for tax payments effectively.

Year-Round Support: Unlike seasonal tax services, we provide year-round support, so you can rely on us whenever you have tax-related questions or concerns.

Educational Resources: We believe in empowering our clients with knowledge. We provide educational resources and updates on tax law changes to keep you informed.

While technology plays a significant role, we also believe in the power of human expertise. Our team of seasoned tax professionals is always ready to provide personalized guidance and advice. When you choose [Your Company Name], you're not just getting software; you're getting a dedicated team of experts who are invested in your financial success.

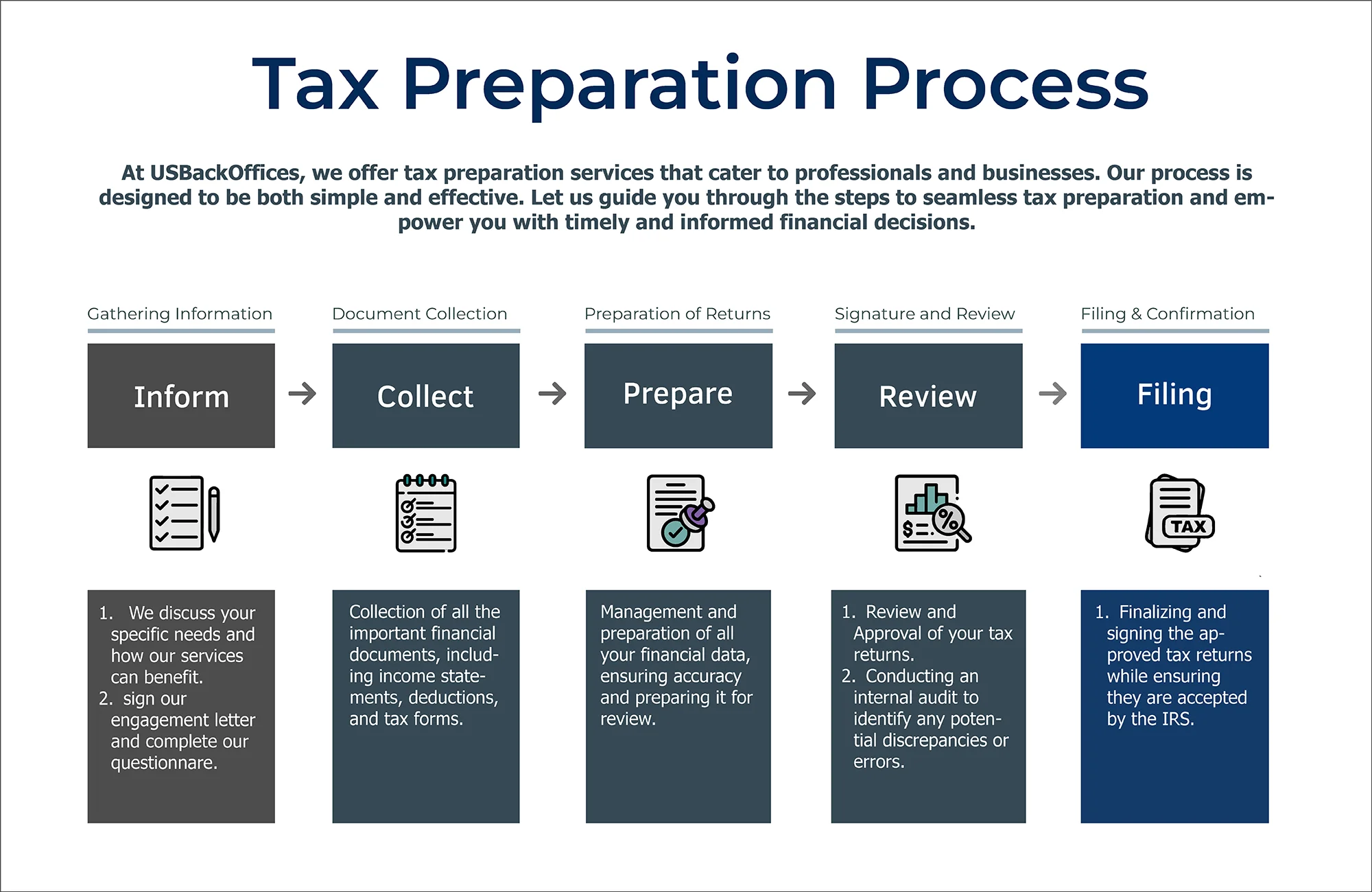

1. Reach out to us to discuss your specific needs and how our services can benefit.

2. Collect all necessary financial documents, including income statements, deductions, and tax forms.

3. Our dedicated team meticulously manages all your financial data, ensuring accuracy, security, and compliance with tax regulations.

4. We provide you with timely and accurate financial statements, empowering you to make informed decisions and plan for the future.

5. Our services adapt to your practice's growth, providing flexibility as your needs change.

Tax Law Proficiency: Our accountants are well-versed in the latest federal, state, and local tax laws, ensuring accurate and compliant tax preparation.

Attention to Detail: We pride ourselves on our meticulous approach, leaving no stone unturned in the pursuit of precision in your tax returns.

Critical Thinking: We approach each tax situation with a critical eye, identifying potential tax-saving strategies and solutions.

Advanced Software Proficiency: Leveraging cutting-edge tax software, our accountants streamline the tax preparation process for efficiency and accuracy.

Communication Skills: Effective communication is key. We ensure that complex tax concepts are explained in a clear and understandable manner.

Client-Centric Approach: We prioritize your needs and goals, tailoring our services to your specific situation and providing personalized guidance.

Data Security: Your financial information is treated with the highest level of security and confidentiality, protecting your sensitive data.

Adaptability: Tax situations vary widely. Our accountants are adaptable and can handle a broad spectrum of tax scenarios.

1337 W 43rd St, Unit #1138, Houston, TX 77018

Office: +832-426-2538

Email: Info@usbackoffices.com